In the fast-moving world of modern finance, accuracy isn’t optional. Reconciliation platforms now automate matching, surface real-time exceptions, and keep you audit-ready — with far less manual effort.

Why Reconciliation Tools Are No Longer Optional

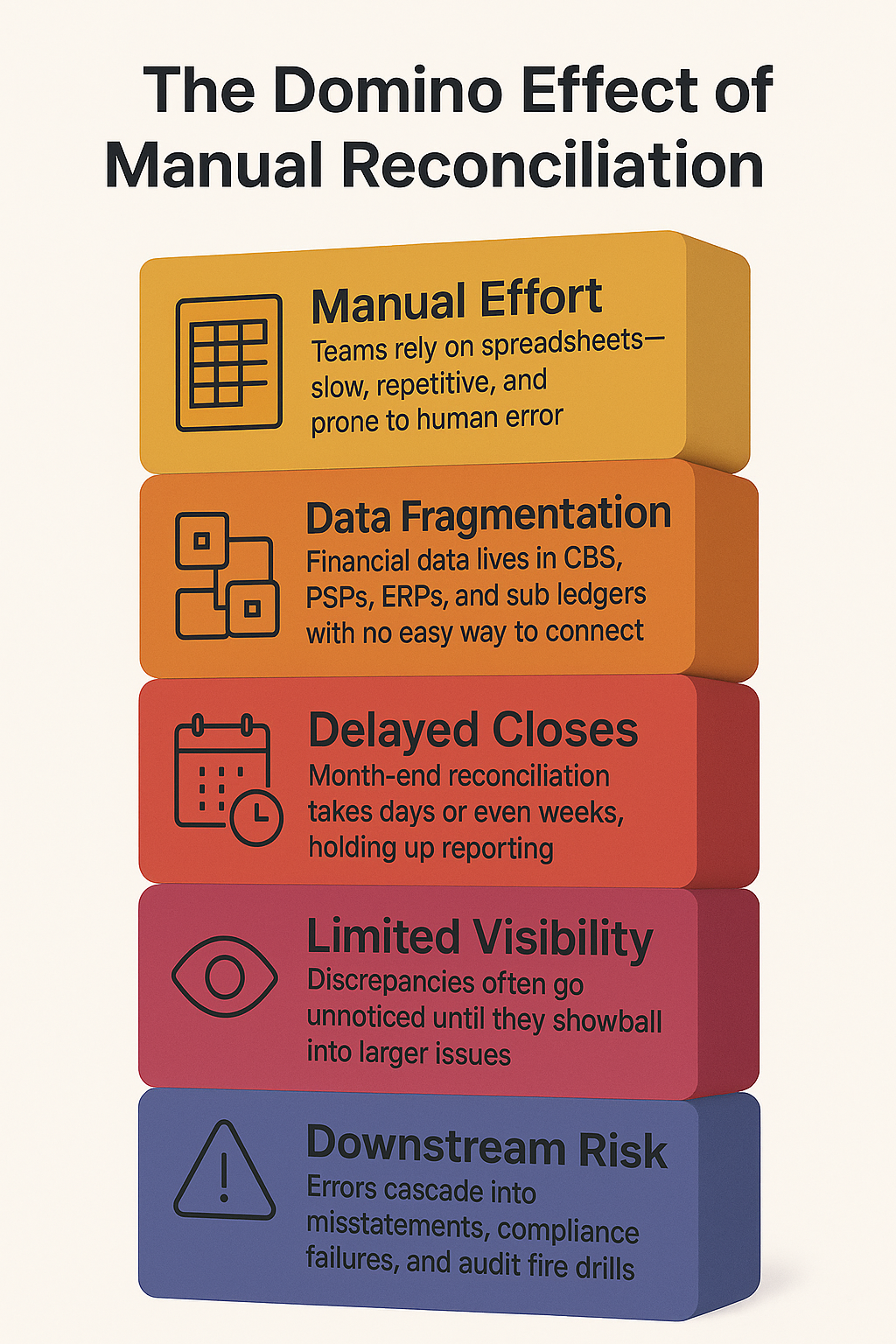

Spreadsheet-driven matching is slow and error-prone. Modern platforms reduce toil and risk by:

Automating repetitive tasks

Rule engines and ML speed up matching and reduce manual correction loops.

Centralizing data

Connect banks, ERPs, payment gateways, and ledgers for a single source of truth.

Creating audit trails

Traceable workflows strengthen compliance and transparency across reviews.

As volumes scale and standards tighten, reconciliation evolves from “chore” to strategic enabler — freeing time for analysis and decisions.

2️⃣ How Reconciliation Tools Help Your Business

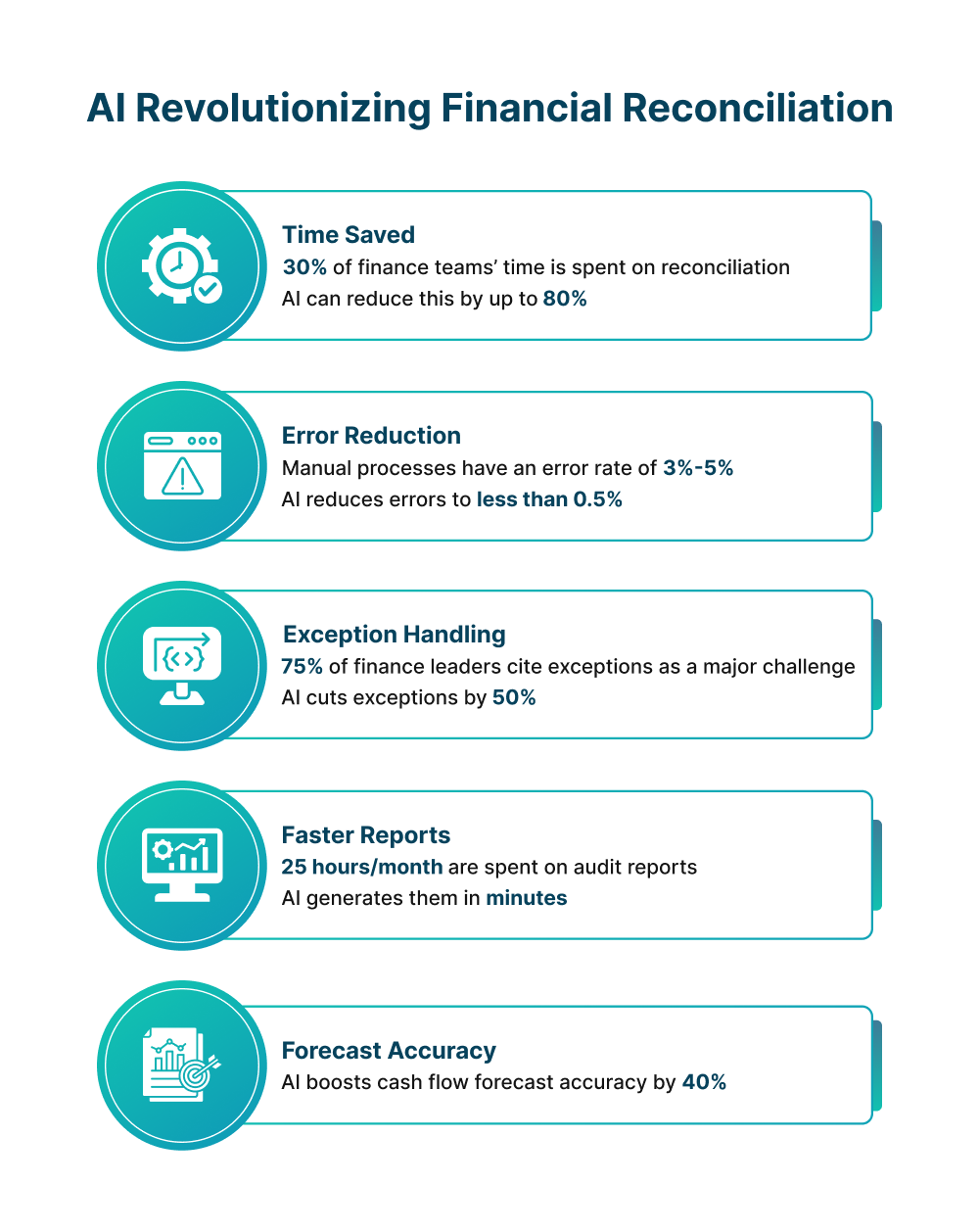

✅ Accuracy & Error Reduction

AI pinpoints mismatches instantly and reduces manual correction loops.

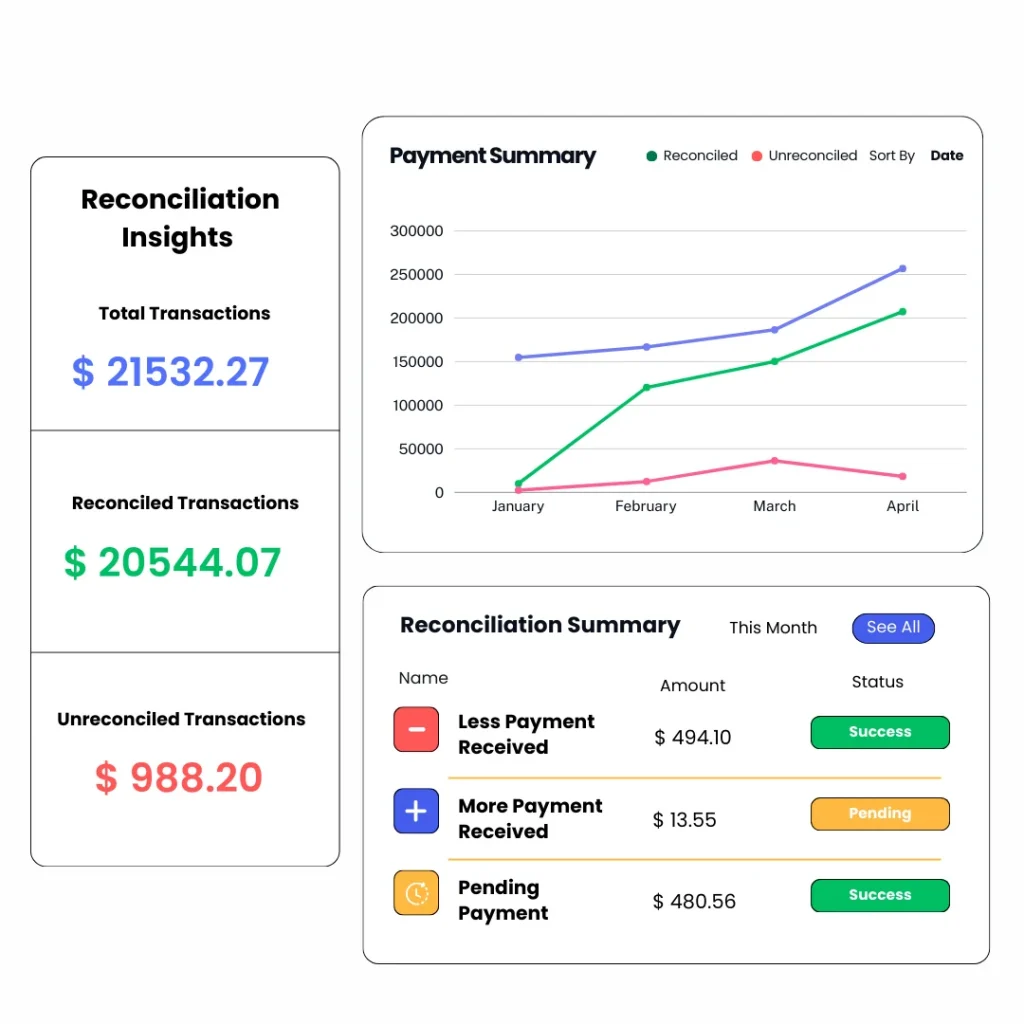

⚙️ Real-Time Insights

Event-driven dashboards reveal balances and exceptions as they happen.

🔐 Compliance Ready

Traceable workflows keep you prepared for internal and external audits.

🌎 Built to Scale

Multi-entity, multi-currency setups without brittle workarounds.

3️⃣ What’s New in Reconciliation Tools (2024–2025)

💡 AI-Driven Rule Creation

ML suggests and adapts rules from recurring patterns — slashing setup time.

🔄 Event-Based Reconciliation

Continuous matching replaces batch cycles with instant balance updates.

☁️ API-First, Cloud-Native

Faster deployments and elastic scale; seamless ERP and banking integrations.

Looking for a reconciliation tool that integrates with your ERP and banking APIs? Compare options in our account reconciliation software guide, or see how to automate reconciliation safely at scale.

4️⃣ Choosing the Right Reconciliation Tool

| Criterion | What to Look For | Why It Matters |

|---|---|---|

| Integration | ERP, banking APIs, data warehouse, flat files | Removes manual imports and broken pipelines |

| Scalability | Auto-scale, high throughput, archiving | Handles peak volumes without delay |

| Customization | Flexible rules, custom workflows, webhooks | Adapts to your operating model |

| Security & Compliance | RBAC, encryption, audit logs, data residency | Protects sensitive financial data |

Leaders to explore: HighRadius, Optimus Tech, Kolleno.

5️⃣ The Future: Predictive Finance

Next-gen systems will predict mismatches before they happen — flag risks, recommend adjustments, and learn from anomalies. Reconciliation becomes proactive and performance-driven, not just a month-end task.

💬 Conclusion: Turn Clarity into Advantage

Reconciliation tools have moved from back-office utility to strategic asset. In 2025 and beyond, AI-powered, real-time, and compliance-ready platforms elevate control, visibility, and trust — so the businesses that reconcile smarter, grow faster.

See a guided demo or get a readiness checklist.